Average practice values are beginning to drop, despite valuations experiencing a small rise, according to the latest NASDAL figures.

Average practice values are beginning to drop, despite valuations experiencing a small rise, according to the latest NASDAL figures.

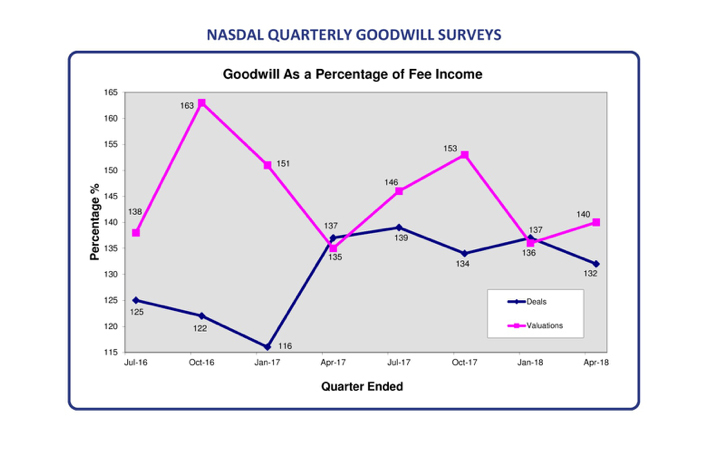

Deals dropped to an average of 132% as a percentage of gross fees, over the last quarter, a drop of 4%.

Valuations have risen however in the same three-month period, up 3% to 140% as a percentage of goodwill.

‘A particular area of note in this survey is that certain practices that are larger and located in the “right place” are gaining from competition between the larger corporate groups such as BUPA, Portman and Genesis as they compete for the sale,’ Alan Suggett, specialist dental accountant and partner in UNW LLP who compiles the goodwill survey, said.

‘Small comfort if you are looking to sell in the “wrong place”!

‘As we have noted previously, geographical factors seem to be becoming increasingly important, and this links with a similar pattern in associate availability.

‘Bank appetite to lend is still very strong, although RBS is now effectively out of the market due to lack of appetite leading to very high interest rate pricing.’

NHS demand

NHS practices continue to be in demand, with a number of sales over the quarter at over 200% of gross fees.

Annual figures from NASDAL show private practice valuations are closing in on NHS valuations.

However, these latest figures show NHS practices are beginning to attract a premium once again.

See previous NASDAL figures: